The Department of Justice (DOJ) recently announced an increase in False Claims Act (FCA) civil monetary penalties for 2023. This increase comes just eight months after the DOJ last increased penalties, making it the second increase in a year.

The new penalties apply to violations that occurred after November 2, 2015, but were assessed after January 30, 2023. As of this date, the minimum civil monetary penalty for a violation of the FCA is $13,508, and the maximum penalty is $27,018. For context, the penalties previously ranged from $12,537 to $25,076.

With FCA penalties increased the DOJ Department of Justice shows that it’s continuing to take FCA violations seriously. It’s vital for companies and individuals to ensure compliance with the FCA as non-compliance could result in hefty fines and other legal repercussions.

If you believe that you may be the subject of a DOJ investigation, contact our Georgia False Claims Act lawyer for proven guidance and representation.

How does the FCA work?

The False Claims Act is a federal law that protects the government from fraudulent claims by individuals or companies. It allows private citizens and whistleblowers to bring actions on behalf of the government against those who make false or fraudulent claims for payment from a federal agency.

The FCA is enforced by the United States Attorney General and the Department of Justice. It includes civil penalties and treble damages, which are calculated by tripling the amount of money involved in the false claim.

A qui tam provision of the FCA also allows whistleblowers to file lawsuits on behalf of the government in exchange for a portion of any money recovered by the government. This creates an incentive for individuals to report fraudulent claims that would otherwise go unnoticed.

How were the new penalties calculated?

The 2023 civil penalty adjustment is part of a periodic adjustment process set in motion by Congress to keep pace with inflation. Under a 2015 law, the DOJ is required to adjust FCA penalties every year, with the adjustment taking effect no later than January of each year. Prior to this law, the penalties were limited to specific dollar amounts set by Congress.

The DOJ uses the Consumer Price Index (CPI) released by the Bureau of Labor Statistics to calculate the annual increased penalty amounts. The October 2022 CPI informed this year’s penalty adjustment. An inflation factor of 1.07745 was applied to the previous penalties, resulting in the new penalty amounts.

A disclaimer about FCA penalties

It is important to note that FCA penalties are just one of the potential consequences of violating the Act. The legal repercussions aren’t limited to a penalty of $27,018 — this is only the maximum civil penalty associated with a single violation.

These penalties are mandatory for each false claim violation. That means that if you are found to have made multiple false claims, the civil penalty amounts will multiply accordingly. So, for instance, if you are found to have made 10 false claims, the maximum civil penalty will be 10 times $27,018 or a total of $270,180.

Treble damages can further raise the monetary consequences of a False Claims Act violation. These damages are three times the amount of money actually lost by the government due to the false claim. This can add up to a substantial sum of money owed to the government in restitution.

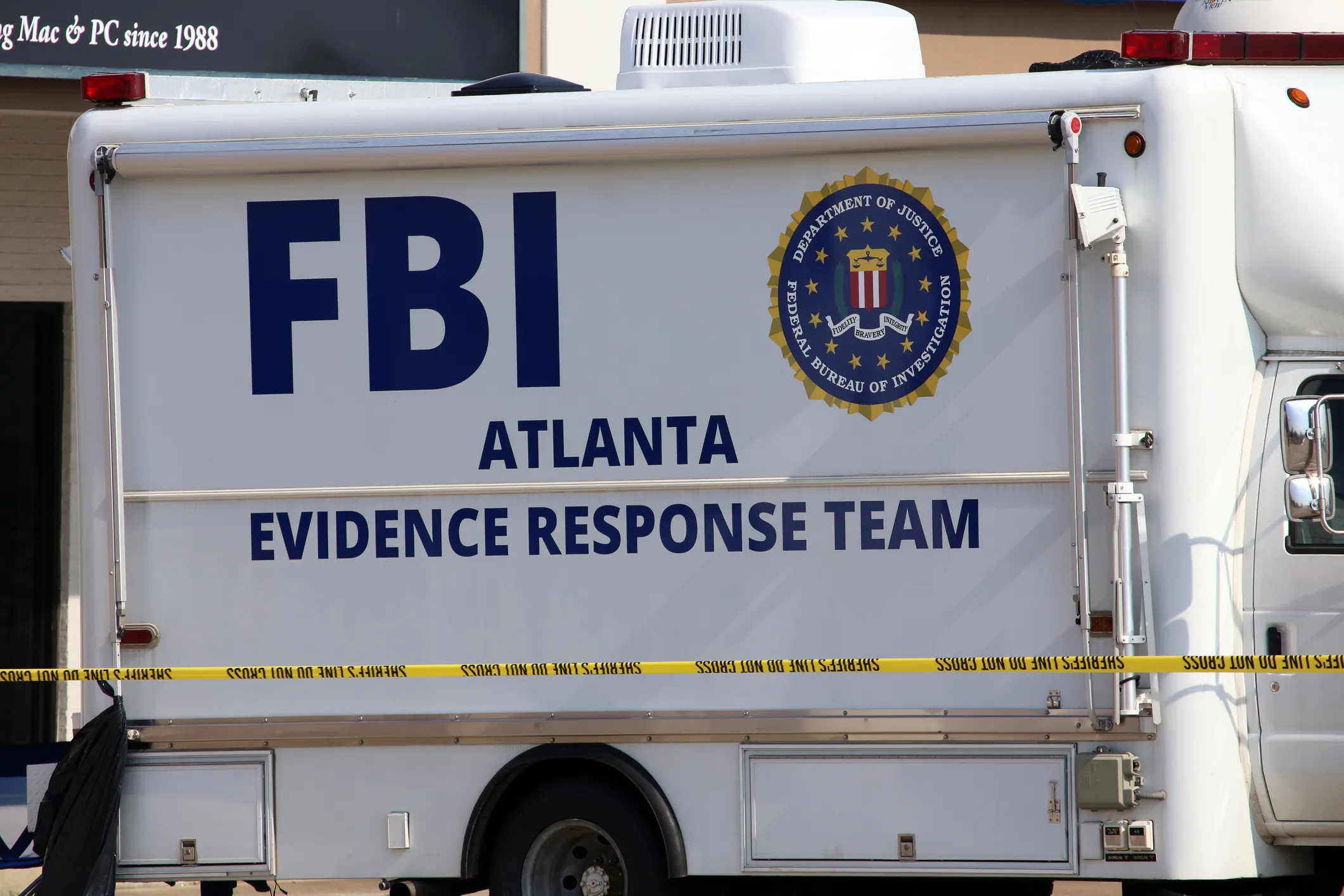

Furthermore, violations of the FCA can also result in a parallel criminal prosecution for the same conduct. The Federal Bureau of Investigation (FBI) and Office of the Inspector General (OIG) usually handle these cases. Criminal prosecutions can lead to penalties that include heavy fines, prison time, or both.

Let us help you navigate alleged FCA violations

It’s clear that the DOJ is continuing to crack down on suspected FCA violations. FCA penalties will only continue to increase as time progresses and inflation continues, and the consequences of non-compliance can be severe.

The team at Griffin Durham Tanner & Clarkson LLC has extensive experience defending companies and individuals facing allegations of FCA violations. When the stakes are this high, you need nothing less than top-tier legal representation, and you’ll find exactly that at our firm.

If you’re facing a possible FCA violation with the DOJ, contact a Georgia False Claims Act attorney at our firm today. You can reach our Atlanta office at (404) 891-9150 and our Savannah office at (912) 867-9140. We look forward to protecting your rights and best interests.